Invest in the Cambridge ecosystem: Part II

Posted on Mar 26, 2020 by Anna Lawlor

Anna Lawlor, co-founder of Luminescence Communications, explains how you can get a slice of tomorrow’s top firms by investing in crowdfunding

Not all of us can launch our own internationally renowned business, but accessing those early-stage, high-potential businesses and reaping the benefits is easier than you might think.

Research suggests that Cambridge is the third best city in the UK to start a business and, combined with Oxford, outperforms Berlin and Paris in the number of so-called ‘unicorn’ companies it produces. Cambridge’s proficiency in creating these £1bn-valuation firms has earned it the moniker ‘Silicon Fen’, a nod to the tech hub across the Atlantic.

Getting your own investment slice of tomorrow’s potential giants isn’t just the preserve of exclusive venture capital firms or top fund managers: crowdfunding is revolutionising funding into early-stage companies.

Crowd power

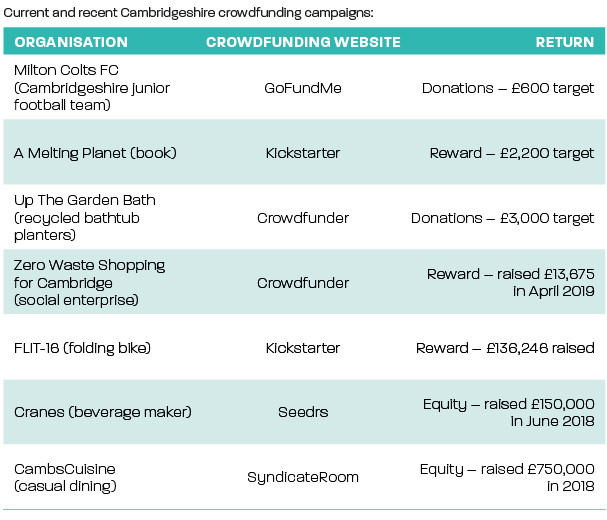

Major crowdfunding websites, such as Kickstarter, Indiegogo, GoFundMe, Seedrs and Cambridge’s own SyndicateRoom, have helped thousands of companies secure funding directly from the public.

These websites allow individuals and organisations to invest in (or sometimes donate to) crowdfunding rounds or projects in return for a potential profit or reward. Indeed, Cambridge Judge Business School’s alternative finance research found £4.2bn of business funding was raised via online platforms and channelled to start-ups and small- to medium-sized enterprises. This figure accounts for 68% of the total market volume for alternative finance.

Crowdfunding as we know it today began back in 1997 when Buckinghamshire-based band Marillion found themselves unable to finance their planned tour of America. The group took the bold – and now widely regarded as visionary – step of contacting fans via the internet to raise £39,000 to help finance the 19-venue stateside tour. This success, and its repeat of the feat in 2001 when 12,000 copies of their unwritten album were pre-sold to fund its production, spawned an industry that is now commonplace.

Cambridge Judge Business School’s research showed the entire UK online alternative finance industry grew by 35% year-on-year, reaching £6.2bn in 2017. Within this, equity-based crowdfunding (where investors own a share of the business) grew by 22% to reach £333m; real-estate crowdfunding grew by 200% to £211m; and donationbased crowdfunding only grew by 2.5%.

Major crowdfunding websites, such as Kickstarter, Indiegogo, GoFundMe, Seedrs and Cambridge’s own SyndicateRoom, have helped thousands of companies secure funding directly from the public

Major crowdfunding websites, such as Kickstarter, Indiegogo, GoFundMe, Seedrs and Cambridge’s own SyndicateRoom, have helped thousands of companies secure funding directly from the public

Cambridge opportunities

Different crowdfunding platforms usually offer either equity-based or donation-based crowdfunding.

The former include opportunities such as that recently offered by Cambridge-based vegan restaurant brand, Stem + Glory, which is plotting a national roll-out. It managed to raise £156,610 from 187 investors in return for 5.7% of its equity, smashing its target of £100,000.

Companies on crowdfunding platforms are allowed to opt to ‘overfund’ if they wish, but for a larger percentage of equity (aka the share of the company’s valuation, which is returned to investors when the company is sold or listed on a stock exchange, or by trading that share with another investor).

On the other hand, donation crowdfunding usually includes causes raising money, such as when St Mary’s Church in Whaddon, Cambridgeshire, raised money on Crowdfunder for a new roof after its lead tiles were stolen.

Accessing these opportunities simply involves creating a free account on one of the crowdfunding websites, which offer simple search functions by category or region. Donation opportunities typically start from £10 and just require a debit or credit card. Equity-based crowdfunding, in addition, typically requires completion of a form.

All crowdfunding campaigns are time-limited and usually money is only drawn down if the company hits its fundraising target. Sites such as Crowdfunder, however, do offer projects a ‘keep what you raise’ option.

Crowdfunding platforms earn money by levying charges on the amounts raised by businesses raising money, or from investors if the company they have invested in increases in value or possibly when shares are sold.

Private equity revolutionised

Tom Britton, co-founder of SyndicateRoom, created his firm entirelyon this basis: to provide a way for the everyday investor to gain access to investment opportunities usually reserved for private equity firms, family offices or high net worth individuals.

Britton says he stayed in Cambridge to launch SyndicateRoom with his fellow Cambridge Judge Business School alumnus, Gonçalo de Vasconcelos, because of the compelling entrepreneurial scene. “The start-up ecosystem in Cambridge is great and the concentration of companies and investors meant we could test the market in Cambridge better than anywhere else,” he explains.

The start-up ecosystem in Cambridge is great and the concentration of companies and investors meant we could test the market in Cambridge better than anywhere else

The start-up ecosystem in Cambridge is great and the concentration of companies and investors meant we could test the market in Cambridge better than anywhere else

In SyndicateRoom’s early days, Britton and de Vasconcelos tapped into the city’s network of so-called ‘angel investors’, a term given to a group of usually wealthy investors willing to back riskier early-stage companies (think Dragon’s Den), to help them launch and subsequently raise £1.2m via crowdfunding on their own website. Among some of their early backers was Peter Cowley, chair of Cambridge Angels, and Jonathan Milner, the co-founder of life science firm Abcam.

In spite of SyndicateRoom’s success with investments such as Oval Medical Technologies (which was bought by US-based pharmaceutical device maker SMC for an undisclosed sum in 2016) and Axol Bioscience (which has raised money in further funding rounds at higher valuations), Britton is open about crowdfunding’s risks.

“Roughly 60-70% of all start-up won’t give their investors any form of return,” he states. “That doesn’t mean 60- 70% go bust. Sometimes they plateau and they might break even, but then they don’t grow enough to be sold and simply trade year to year. They earn enough to pay their employees a salary, but not enough for investors to get money back.”

He adds that investment time horizons are also longer than the three to five years many people think – often “two to three times that” – and that crowdfunders should not expect a quick exit.

Show me the money

Like all investments, crowdfunding comes with financial risks and professional advice should be sought before investing. Firms raising money on crowdfunding websites are usually small or start-ups, which are inherently considered riskier (ie prone to failure).

Research by start-up database Beauhurst for The Sunday Telegraph found that, between 2013 and 2015, 21% of businesses that had raised money through a crowdfunding website had collapsed. This is better than the just-under 50% failure rate for all new businesses, according to the Office for National Statistics, but is still arguably riskier than buying shares in larger, established companies listed on the stock market (see Cambridge Catalyst issue 02).

Notable crowdfunding success stories include Aberdeen-based brewer BrewDog – which has just opened a bar in Cambridge – whose disciples, dubbed ‘equity punks’ after the brewer’s Punk IPA beverage, now have a stake in a company valued at almost £1bn after US private equity investor TSG Consumer Partners bought just over a fifth of the company for £213m in 2017.

Other crowdfunding trailblazers include hourly low-emission car hire firm E-Car Club, brewer Camden Town Brewery, knitting and crochet business Wool and the Gang, and fintech start-ups Monzo and Revolut, which raised £2.5m and £3.9m respectively.

On Crowdcube, just six – including some of those named above – have returned actual money to investors, while slightly more than half (55%) of 180 businesses on Crowdcube raised money again at a higher valuation after their initial cash call, giving investors a profit ‘on paper’. Websites that match buyers and sellers of shares in crowdfunded companies have emerged, but transaction charges apply.

Cambridge has a buoyant and lively crowdfunding and angel-investing scene

Cambridge has a buoyant and lively crowdfunding and angel-investing scene

Vibrant crowd

Cambridge has a buoyant and lively crowdfunding and angel-investing scene. Organisations such as Cambridge Angels, Cambridge Capital Group and IQ Capital are networks of private investors, family offices and venture capital funds that help provide capital to some of the city’s most innovative businesses.

A whole host of businesses, from restaurants, drinks manufacturers, bioscience companies and financerelated apps all based in Cambridge have or are raising money via crowdfunding websites – giving everyone an opportunity to invest in the Cambridge start-up scene.

Our crowdfunding story

Flit, Cambridge-based makers of lightweight, folding e-bikes, tell Catalyst about their phenomenal kickstarter success

Dave Henderson and Alex Murray started Flit while living in Beijing. Dave, an ex-Jaguar Land Rover engineer and Alex, a management consultant, were both keen cyclists and wanted to work on ways to improve how people get around cities. Inspired by the rapid uptake of e-bikes in China, they believed these machines could be reworked for cities back home.

After developing early ideas in Beijing, they moved back to the UK to set up Flit, which focuses on folding e-bikes that are quick and manoeuvrable for urban commutes, but also small and light enough to take on public transport.

The FLIT-16 achieves this by being 30% lighter and smaller than a typical folding e-bike. Designed to be electric from the start, it has all of its electronics built into the frame for a clean look and can fold in less than 10 seconds. Built-in lights, the ability to roll it while folded and a custom suspension system take the hassle out of city riding even more.

We have been very happy in Cambridge: we're never more than a couple of introductions away from a solution to whatever problems we are trying to solve, whether it's to do with material science, or how to set up a marketing campaign

We have been very happy in Cambridge: we're never more than a couple of introductions away from a solution to whatever problems we are trying to solve, whether it's to do with material science, or how to set up a marketing campaign

Why did you choose Cambridge to launch the company?

Cambridge is the perfect city for Flit: it’s the UK’s cycling capital, with more than 30% of people in the city cycling to work. Its full of talented engineers and has a great start-up ecosystem with lots of other young companies to learn from and swap tips with. We’ve been very happy in Cambridge: we’re never more than a couple of introductions away from a solution to whatever problems we are trying to solve, whether it’s to do with material science, or how to set up a marketing campaign.

Why did you choose to go down the crowdfunding route?

Reward-based crowdfunding is great for hardware start-ups like Flit, because it allows us to gather together backers for our first manufacturing batch. After spending three years on R&D and a year working with a manufacturer, we are now confident that we are ready to deliver e-bikes to customers.

However, manufacturers usually require orders to be made in minimum order quantities. Pre-selling e-bikes through crowdfunding lets us meet these minimum order targets. In return, people who back us through crowdfunding receive a massive discount on their e-bikes. When done right, crowdfunding is a means of raising capital that benefits everyone: customers, product developers and manufacturers.

Which crowdfunding platform did you choose and why?

We decided to launch on Kickstarter, because it has a big audience and a good reputation. Crowdfunding is new for many people (almost half of our backers have never used crowdfunding before) and buying an e-bike is a serious investment, so it was important to us that the platform we used had a good reputation. On top of this, Kickstarter has a large, active community. It’s great to be able to interact with this community for tips and suggestions. For example, some of the questions we have been asked have been very insightful and have helped us make decisions about add-ons for the project where we received a lot of the same requests.

How did you find the experience?

We initially targeted £25,000 as this is what we needed to finalise tooling and order parts for the first manufacturing batch. We passed this within four minutes of launching the campaign, which was a great feeling! With two weeks of the campaign to go, we were on £112,500, which gave us all we needed to complete manufacturing and shipping, although higher volumes will make this easier. The experience has been really positive. We have invested a lot of time travelling around the UK, doing hundreds of test rides in places like Silverstone racetrack, where we exhibited at the Fully Charged Live show. This gave us the opportunity to meet lots of interesting people. We even had one backer come from the Netherlands for a day to test ride the e-bike! It turns out he was involved in the early development of the Ultimaker 3D printers – a company we admire – and had lots of stories to tell and suggestions for e-bike modifications. Only through communities like Kickstarter can you meet so many interesting people who are genuinely interested in your product. What you learn from this community as a product develops is invaluable.

Do you have any advice for other would-be crowdfunders?

The most important advice is to plan well in advance. Crowdfunding typically requires six to 12 months of preparation. You not only have to ensure your product is well developed with as many kinks ironed out as possible, but you need to ensure you have a community of people who are interested in what you are doing. This requires a lot of outreach and relationship building, which is worthwhile and will help ensure you are heading down the right path. You will know you are on the right track if you have a positive reception when you launch. After that, the trick is to maintain your early momentum by getting the word out so other people can see how excited you and your backers are by what you are working on. For us, this has involved a lot of time on the road doing test rides and answering questions, but also reaching out to the press and organisations who can help us spread the message.

What’s next?

Our Kickstarter campaign closed on 7 September and we raised £136,246 – more than 544% times our funding goal! This was while we were over in Germany for the Eurobike trade show. We timed it well, as Eurobike is one of the biggest bike trade shows in Europe, and we were also pitching for the prestigious Startups Award. Now that our Kickstarter campaign has finished, we are going into production with our first batch of FLIT-16 e-bikes, which is exciting. Our e-bike is still available on Indiegogo InDemand, with the price gradually increasing as we get closer to delivering the FLIT-16 to customers in spring 2020.