Invest in the Cambridge ecosystem: Part III commercial property

Posted on Apr 1, 2020 by Anna Lawlor

Anna Lawlor, co-founder of Luminescence Communications, on the pros and cons of investing in commercial property

With Cambridge’s seemingly ever-buoyant property market attracting international interest and the expansion of myriad property developments springing up, is commercial property the missing asset class in your investment portfolio?

Commercial properties are premises that house the likes of shops, warehouses, offices, cafes, hotels, restaurants and pubs, and are usually owned by an individual, company or organisation that then rents them out to a tenant.

The collection of this rent provides an income stream for the owner – as does any price rise if the building is ever sold – making it an attractive asset class to include in a portfolio.

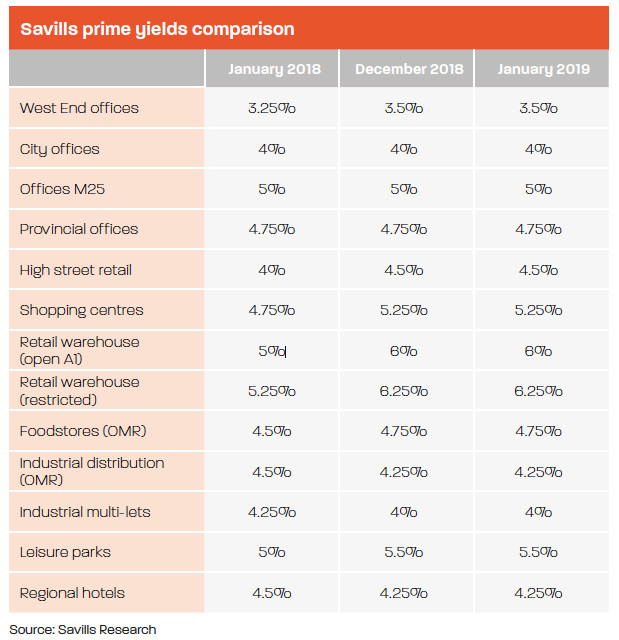

With UK commercial property investment volumes hitting £62.1bn in 2018, according to estate agent Savills, plenty of people seem to be doing it, too.

While last year’s figure was 5.7% below that of 2017, it was comfortably above the three-year rolling average of £59.8bn, suggesting commercial property investors have largely regained their confidence after the shock they exhibited on the back of the EU referendum result.

Snapping up a commercial property might sound ideal, but there is a lot to consider.

Direct or indirect?

A crucial decision is whether to make your property investment directly or indirectly. A direct investment means either buying a property – its freehold or leasehold – and generating a return from a tenant or setting up a business there, or investing in a fund that does the same thing. An example of this would be M&G Real Estate, which recently purchased a warehouse development on Buckingway Business Park in Cambridge for £22m.

An indirect investment includes investing in the shares of property companies, developers or housebuilders, or investing in a fund or real estate investment trust (known as a Reit) that targets the same opportunities, but can be traded similarly to shares (see issue 2 of Cambridge Catalyst for more on this).

Commercial property investors have largely regained their confidence after the shock they exhibited on the back of the EU referendum result

Commercial property investors have largely regained their confidence after the shock they exhibited on the back of the EU referendum result

Location, location, location

Where you want your property investments to be located might help make the direct or indirect decision. Investors don’t have any control about where a fund manager buys property for their fund but a direct investor can choose to home in on one location, such as Cambridge.

That being said, as Philip Woolner, a managing partner at Cheffins in Cambridge warns, commercial property investment is “not for the uninitiated”.

“If you don’t know what you are doing then you need to take good advice from a surveyor,” he says.

“Freehold transactions are more straightforward, but some investments are long leaseholds. You need to look carefully at what the leaseholder interests are to ensure what you are buying is a good investment.”

To reinforce the point, Woolner states that residential leasehold documents might be roughly three to four pages whereas a commercial lease would be a minimum of 35 pages – although often around 65 – and each one is usually different to the next.

Other major considerations are the financial strength of your tenant and whether you believe they will remain in business for a long time. Just like with a residential let, if you don’t have a tenant, you still have to pay the mortgage.

While a high-demand city is attractive to investors, this means intense competition for investable properties, reducing available real estate stock

While a high-demand city is attractive to investors, this means intense competition for investable properties, reducing available real estate stock

Competitive Cambridge

While a high-demand city is attractive to investors, it means intense competition for investable properties, reducing available real estate stock.

Savills cites Cambridge as a city that has low office availability and limited choice for occupiers. This means valuers are applying higher rental value growth and above average increases in capital values; you pay higher prices for the same property stock, and profitability is squeezed.

Philip Woolner says the competition to own property in the city is “quite intense, because the story of Cambridge is so good”.

“Cambridge stands out for the growth potential everyone sees here as well as its sector-specific nature,” he says. “This is one of the places in the world where tech businesses want to come and set up their research and development (R&D) facilities.” This view is substantiated by the recent move from Chinese communications giant Huawei, which splashed out £37.5m on the 550-acre former Spicers site at Sawston.

Large amounts of central Cambridge are owned by the university and its respective colleges: the combined property holdings of Oxbridge colleges were worth £3.5bn, while the universities collectively hold property investments worth £863m in 2018.

Beyond this, strong demand means rents are being pushed ever higher, possibly reducing the pool of tenants who will be able to afford the monthly payments: prime sites in Cambridge are now demanding around £45 per square foot compared to between £20 to £25 a decade ago, according to city agents.

More broadly, the city’s local plan, adopted in October 2018, predicts 44,000 jobs and 33,000 homes will be created by 2031. For smaller investors, therefore, investable opportunities may be more attractive outside the city.

Philip Woolner suggests “looking where the chimney pots are going”, given that larger residential developments are likely to be accompanied by a surge in surrounding commercial property.

Action required

Just like any asset, care and attention is needed to achieve results in commercial property. A tenant is only going to want to pay the market rate if the building is of a good standard, which might require further investment from the owner post-purchase.

Attracting – and importantly keeping – a tenant is vital to the success of a commercial property investment, too. Not only does their rent pay the mortgage but a high-quality tenant could bolster the property’s capital value during an economic downturn.

Given that Savills expects price appreciation to account for less than one third of total returns across UK property for 2019 to 2023, keeping tenants happy will be extremely important for any near-term property investment.

Picking a side

Before deciding how to keep your tenants happy, you need to identify which type of tenant you want. Such a decision obviously has a huge impact on the building you invest in, given the needs of a retail or an industrial tenant, for instance, are very different.

Care and attention is needed to achieve results in commercial property. A tenant is only going to want to pay the market rate if the building is of a good standard, which might require further investment from the owner post-purchase

Care and attention is needed to achieve results in commercial property. A tenant is only going to want to pay the market rate if the building is of a good standard, which might require further investment from the owner post-purchase

Analysing industry data is a useful way of deciding which sector to target. The Royal Institute of Chartered Surveyors (RICS) produces its Tenant Demand Indicator on a quarterly basis. This remained in negative territory for the fifth consecutive quarter in Q2 this year, but the retail sector was largely responsible for this, while tenant enquiries for industrial space “continued to rise smartly”. If possible, it would be sensible to diversify your commercial property investments. Large institutions that invest in the sector will often have exposure to multiple areas. Cambridgeshire County Council, for instance, recently snapped up the 986-year leasehold of a Tesco site and industrial land in Peterborough for a combined £63m as part of its ambition to grow income from commercial property from 3% of its budget now to 15% within the next five years.

If picking a winner seems overwhelming or the likelihood of raising the necessary finance is a tall order, online property investment marketplaces have made it possible to invest in mortgages.

Companies such as Lendinvest allow individuals and institutions to invest in mortgages secured against UK properties. Such websites allow you to create a portfolio of property investments, providing the possibility of accessing several industries at once.

Of course, just like more direct investments, the prices of the properties that these mortgages are secured against could fall and economic pressures could also stretch the finances of tenants, making it more likely they might negotiate for rent relief or even default on their lease.

Just like any investment, taking on a commercial property warrants serious consideration – and professional advice too – to help ensure you make the best use of your money.

Experts also recommend investors have a well-diversified portfolio, which means a good mix of different assets classes such as equities, bonds, property and alternatives, such as energy. This is because it is lesscommon for these asset classes to move in the same direction (increase/ decrease in value) simultaneously, giving a diverse portfolio a better chance of providing positive returns over the long term.

RICS data shows that nationally, 53% of respondents to its survey view the commercial property market as in some stage of a downturn, with fear heightened in London due to Brexit uncertainty.

Nonetheless, those in the market are expecting a ‘soft landing’ rather than a full-blown crisis at present, meaning it might be worth doing your homework on property investment.

Commercial mortgages

Just like with a residential property, most individual investors are unlikely to have the necessary spare cash to buy a commercial property outright. This means a mortgage will be needed to complete a transaction.

While notionally a residential and commercial mortgage are the same thing, lenders such as banks and building societies are likely to demand a bigger deposit for the latter. According to Cheffins partner Philip Woolner, commercial property borrowers are more likely to be offered two thirds to three quarters of the value of the property as a mortgage, unlike the more common 80 to 90% for residential property transactions.

“Commercial property is seen as more of a specialist product and potentially more vulnerable to valuation swings,” he says. “The bank wants to know that you can service the loan.”