Invest in the Cambridge ecosystem: Part IIII Bonds

Posted on Apr 2, 2020 by Anna Lawlor

Anna Lawlor explains what bonds are, how they work and how you can use them to invest in Cambridge businesses

From wars in France to electric car charging points in Cambridge, bonds have given investors access to innumerable investment opportunities.

In the final instalment of our Invest in the Cambridge Ecosystem series, we’ll explore how bonds work, what they offer the investor and the borrower, and unveil some Cambridge-specific investment opportunities.

Steady investments

Investors are constantly searching for a sure-fire investment that won’t let them down. While no investment can guarantee a return, bonds – a ‘fixed income’ asset class – are generally regarded as being a lower risk investment, and an important part of an investment portfolio.

Bonds are essentially an ‘IOU’; a loan made by an investor to a borrower. The amount of financial return is pre-agreed, fixed and there are terms about when that money is due to be paid back to the lender (the bondholder).

While no investment can guarantee a return, bonds are generally regarded as being a lower risk investment

While no investment can guarantee a return, bonds are generally regarded as being a lower risk investment

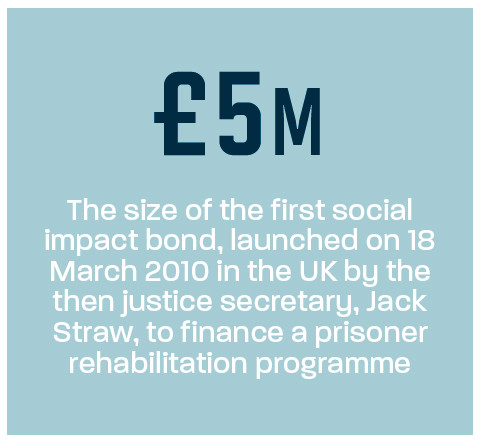

This means bond investors own debt linked to the entity they have lent their money to through the bond purchase. To fund his cross-Channel campaign, William of Orange used the first launch of a bond by a national government in 1694, igniting a nascent industry that would balloon to $255 trillion in size more than three centuries later.

Now, bonds are issued by governments, companies and even social impact organisations all over the world as a way to quickly raise money to fund their development.

When bonds are launched, an offer document states when the principal of the loan – which is the capital the investor has lent – is due to be repaid (known as the maturity date of the bond). It will also outline terms of the income payments that will be made by the borrower. Once a bond is launched, if it is listed, it can be traded on a secondary market, such as the London Stock Exchange, just like a share in a company.

Usually, the larger – or ‘safer’ in the eyes of investors – the organisation is, the more likely it is considered to be able to pay the loan back, and in return the more money it will be able to borrow at a lower interest rate.

Anyone considering investing in bonds can gauge how ‘safe’ the borrower is by looking at its credit rating

Anyone considering investing in bonds can gauge how ‘safe’ the borrower is by looking at its credit rating

Rating guide

Anyone considering investing in bonds can gauge how ‘safe’ the borrower is by looking at its credit rating. Theserange from AAA rating – held by just a few nations, including Australia and Canada and organisations including the University of Cambridge – down to D rating. Anything below BB is considered high-yield or a ‘junk’ bond.

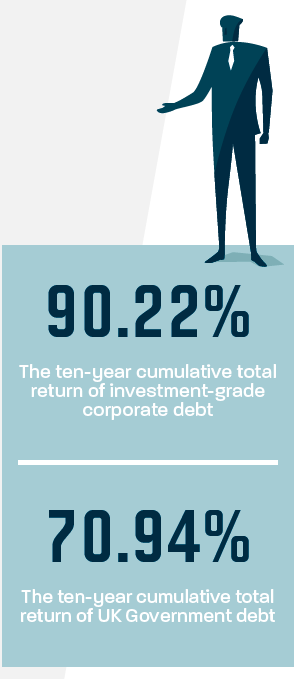

This means sovereign bonds – for instance, those linked to highly developed countries in the G7 – are unlikely to provide a high level of return, but repayment is virtually guaranteed. However, companies that issue bonds – which are known as corporate debt –

often have to pay higher interest rates to

investors, even if they have a rock-solid

credit rating.

This is because they are reliant on generating profits to pay bondholders back. Although the majority of corporate debt is repaid, the asset class still carries risk. Companies can miss payments to investors, as retailer House of Fraser did twice in 2018, or find themselves in a situation where they have to restructure their debt.

PizzaExpress, one of the UK’s oldest dining chains, faced pressure in 2019 to restructure its debt as trading conditions on the high street lumped pressure on the company. Restructuring may include agreeing a lower interest rate repayment with bondholders.

Inflation is also the enemy of bonds. Because bond payments are fixed, any rise in prices means the real return from bonds (the return after inflation) reduces. If a bond matures in one year, this is a short-term issue. But for an investor in a ten-year bond, rising inflation could gradually erode the bond’s real returns as the years pass by. Some issuers do, however, offer inflation-protected bonds that have variable or ‘floating’ interest rates.

Investors are compensated for the risk they take with their investments. This is reflected in the price they pay. The lower the interest rate – or yield – on a bond, the more expensive it is and vice versa: with a higher interest rate (meaning the bond is viewed as more ‘risky’) the price falls.

Cambridge bond opportunities

The bonds on offer from Cambridge related businesses and organisations also offer varying degrees of risk and reward. The University of Cambridge, one of the world’s most prestigious academic institutions, has bonds that trade on the London Stock Exchange. This means anyone can invest in these bonds. In characteristic pioneering form, in 2018, the university issued £300m of 50-year bonds linked to the higher rate of inflation, the Consumer Prices Index (CPI), which rose 1.5% in the 12 months to October.

This move caught the market’s eye, garnering headlines in the Financial Times because the vast majority of inflation-linked bonds are connected to the higher Retail Prices Index (RPI), which rose 2.1% over the 12 months to October.

Investors have been pressuring the UK’s Debt Management Office to launch more CPI-linked bonds since 2012, when the RPI measure lost its status as a trusted measure of inflation. Problems with how some of the data is collected are believed to exaggerate the difference between it and other measures of inflation.

The vast majority of bonds can be easily bought and sold on markets, such as the London Stock Exchange, just like equities

The vast majority of bonds can be easily bought and sold on markets, such as the London Stock Exchange, just like equities

Double impact

At the other end of the spectrum to the AAA-rated University of Cambridge, the city also offers investors the chance to support smaller organisations.

Cambridge-based Allia, which provides support to start-up organisations, bought a majority stake in fixed income broker City & Continental at the start of 2019. Allia’s impact finance arm was then combined with the acquisition to create Allia C&C, which specialises in connecting social and commercial enterprises with investors.

At present, eight retail charity bonds from seven organisations helped by Allia C&C are trading on the London Stock Exchange (and can be found on Retail Charity Bonds’ website: retailcharitybonds.co.uk/bonds-listing). These bonds range in yield from 3.9% to 5%, with most being linked to housing associations, for example Golden Lane Housing and Hightown Housing Association.

Elsewhere, bonds linked to Cambridge-based projects have also been sold via investment website Ethex, which again has an ethical skew. Electric Blue, which provides electric vehicle charging ports powered by renewable energy, raised more than £480,000 from 130 investors, enabling it to install and run 18 rapid-fire electric vehicle charging points in Cambridge for electric taxis.

The bonds, which could be held in a Stocks & Shares ISA for tax-free returns, were aiming to provide annual returns of 5% to 7% to bondholders. Electric Blue’s bonds, however, are unlisted, so once bought, they generally have to be held until maturity. Capital is at risk with these types of bonds and returns are not guaranteed. The financial regulator, the FCA, says in its guidelines that investors should not invest more than 10% of their annual wealth in these types of bonds.

Elsewhere, two Cambridge schools were able to install solar panels this year thanks to funds raised through bonds. Solar for Schools installed solar panels at St Laurence Catholic Primary School and St Bede’s Inter-Church School with money raised on the Ethex website.

The Bury St Edmunds-based organisation has installed solar panels on 84 schools since February 2015 and is currently raising £250,000 via an Innovative Finance ISA eligible bond, targeting a 5% return to bondholders.

Buying bonds for your portfolio

The vast majority of bonds can be easily bought and sold on markets, such as the London Stock Exchange, just like equities. This means you can ‘trade’ your bond, selling it before the maturity date to release some money sooner. Any capital gains –secured if you sell a bond for a higher price than you bought it – do not trigger capital gains tax.

Investors considering buying bonds should do so through tax-efficient products, such as ISAs or Self-Invested Personal Pensions (SIPPs) to avoid being taxed on any income they receive.

If choosing the right bonds seems too daunting, it makes sense to invest in a bond fund that pools multiple investments into one product. Investors can choose from a range of different bond funds, from ‘strategic’ bond funds, which invest in a mix of corporate and sovereign debt, to funds that focus solely on company or country debt.

Barring a company or organisation going bust, investors have a high chance of getting at least some of their money back through the scheduled payments that bonds offer. If a company falls into liquidation, bondholders are paid before shareholders if any money is recouped from the defunct business.

Anyone considering investing in bonds, or any asset class, should consider consulting a professional financial adviser before investing.

Diverse options

The vast array of bonds on offer – from debt of major countries to social impact organisations – means investors have plenty of ways to spread risk. Besides bonds from different borrowers, investors can select bonds from different countries, companies and organisations across the world with varying levels of risk and reward. Investing in a mixture of these alongside other asset classes – including those covered in our investment series – can be a sensible approach to building a portfolio that can produce returns through most market conditions.

Anna Lawlor is the co-founder of Luminescence Communications. Additional reporting by Bradley Gerrard.